Stay ahead of the curve with our exclusive Q&A series, brought to you by leading law firm, A&L Goodbody, LLP, designed to answer your most pressing legal questions. These expert insights provide clear guidance to ensure your HR practices remain compliant and protect your organisation.

In this month's Q&A, Jason McMenamin, Associate in A&L Goodbody's Employment Group, provides an update on key features of auto-enrolment and the Automatic Enrolment Retirement Savings System Act 2024 (the AE Act).

The State’s automatic retirement savings system called “My Future Fund” will now begin on 1 January 2026 instead of the planned commencement date of 30 September 2025. The establishment of My Future Fund under the AE Act aims to increase supplementary pension coverage across the Irish workforce. The Minister for Social Protection has highlighted that the new launch date for the scheme will align with the start date of the tax year and provides a further three months for payroll providers and employers to prepare for the introduction of the scheme. As there is no “one size fits all” approach to compliance, preparations for implementation should remain high on the priority list for employers in the months ahead.

What is auto-enrolment?

Auto-enrolment is a new retirement savings system which aims to increase pension coverage amongst employees in Ireland.

Who will be automatically enrolled and who will not?

All employees between the age of 23 and 60, who earn at least €20,000 across all employments and who are not in exempt employment, will be automatically enrolled in My Future Fund. A new authority – the National Automatic Enrolment Retirement Savings Authority (NAERSA) - will assess income reported through payroll and provide a notification to employers if an employee is to be enrolled in My Future Fund. In line with Section 50(7) of the AE Act, employers are required to inform their employees when they are first enrolled onto the scheme.

Employees aged between 18 and the State pension age (currently 66) who do not meet the criteria can opt in to the scheme provided they are not in exempt employment. All conditions applied to automatically enrolled employees in respect of contributions from the State, the employer and the employee will also apply to those employees who choose to opt in.

An employee will be in exempt employment if they and/or their employer contribute to a “qualifying pension arrangement”. These arrangements include occupational pension schemes, Retirement Annuity Contracts (RACs) and personal retirement savings accounts (or PRSAs). Minimum standards will be published by NAERSA by the beginning of year seven which will specify minimum contributions that must be paid to a qualifying pension arrangement at that time for the employment to continue to be exempt employment.

How will employees be assessed for enrolment?

In carrying out initial assessments as to the eligibility of employees for entry into the scheme, NAERSA will apply a lookback period of up to 13 weeks in respect of relevant Revenue payroll data. If the lookback period indicates that an employee meets the threshold of earning over €20,000 over a 12-month period – which is satisfied by the employee having earned a minimum of €5,000 gross during the lookback period – the employee will be automatically enrolled.

Employees who have commenced employment for the first time, or who have had a considerable gap between their prior and current employment, can expect for enrolment into the scheme to take up to 13 weeks. Contributions will not be backdated to include this eligibility assessment period.

PRSI class information will also be assessed to identify individuals who will not be eligible for auto-enrolment, including individuals participating in Community Employment and Job Initiative schemes and those who are self-employed.

If an employee is under 23 years of age or over 60 years of age, or earns less than €20,000 a year, they will be able to opt in if they wish. All auto-enrolment conditions, such as contributions from the employer, the employee and the State, will apply for employees who opt in. NAERSA will operate an employee portal which employees will be able to log into using their MyGovID credentials. Employees will be able to use this portal to opt into the scheme. Employers will then be notified through the payroll system that the employee is part of my Future Fund.

How will it work?

As mentioned above, NAERSA will administer My Future Fund and will determine if individuals are eligible for auto-enrolment using Revenue payroll data. NAERSA will send an Automatic Enrolment Payroll Notification (AEPN) through payroll software. Employers will apply the notification and calculate the contributions and send to NAERSA who will collect the State top-up separately. The contributions will be visible on the employee’s payslip. Contributions must be paid at the same time as the employee is paid, and contribution information must also be provided to NAERSA. If an employer does not use payroll software, they will be facilitated on the employer portal.

Who will be required to pay contributions and at what level?

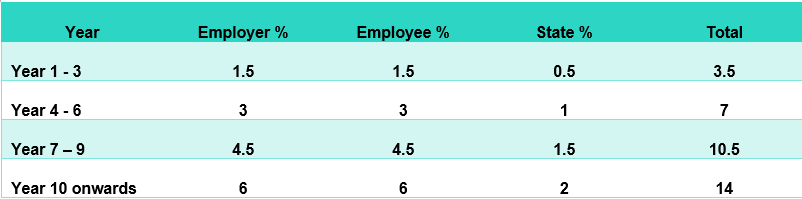

Employers, employees and the State will be required to make contributions based on a percentage of an employee’s total remuneration (capped at €80,000 per annum) into My Future Fund. The contributions will increase on a phased basis as follows:

How can employers manage contributions to My Future Fund?

NAERSA will operate an employer portal which employers will need to register for. The employer and/or their tax agent will be able to use their Revenue Online Services (ROS) credentials to log in to the employer portal.

Through this portal employers will be able to access information about contributions paid and owed and set up direct debit arrangements. As mentioned above, this portal will also facilitate employers who do not use payroll software to pay contributions.

Will employees be able to control their contributions or opt out of My Future Fund?

Employees will have access to an employee portal operated by NAERSA to view their pension savings, contributions and investment returns. The portal will also allow for employees to opt out, suspend contributions or opt-into the scheme.

Auto-enrolment contributions are set at the above rates, there is no option for employees to decrease/increase the level of contributions – other than by opting out or by suspending contributions. The current scheme does not allow for employees to make additional voluntary contributions.

Once enrolled, employees may opt out of the scheme after a 6-month minimum participation period. If an employee chooses to opt out of the scheme, they will be refunded their employee contributions. However, employers will not receive refunds for employer contributions. Both employer and State contributions will remain in the employee’s pot.

What if an employer has a pension scheme and an employee does not join or opts out?

If a new hire decides not to participate in the company occupational pension scheme, or if an existing employee opts out of the company occupational pension scheme, the employee will be auto enrolled into My Future Fund.

What are the consequences of failure to comply with the legislation?

All employers with at least one employee who is subject to income tax in Ireland will need to comply with the legislation. It is important to note that a breach of the legislation is a criminal offence with sanctions ranging from fines of €5,000 to €50,000 and potential imprisonment, depending on the offence committed.

Employers are also prohibited from hindering, penalising or threatening penalisation against an employee for participating or proposing to participate in My Future Fund. Penalisation is widely defined under the legislation and includes, for example:

- suspension, lay-off or dismissal

- demotion, loss of opportunity for promotion nor withholding of promotion

- negative performance assessments

Claims in respect of penalisation could result in a direction from the WRC (or the Labour Court on appeal) to an employer to:

- facilitate the employee’s participation in My Future Fund

- pay any contributions due for that employee from the date they should have been enrolled

- rectify any contraventions of the legislation

- award compensation in favour of the employee (up to four weeks’ remuneration)

What should employers be doing right now?

- Examine carefully who from within your workforce will be automatically enrolled and who will not.

- Make any necessary changes to existing pension arrangements and employment contracts to take account of the AE Act.

- Take action sooner rather the later. Every employer in Ireland must be compliant by 1 January 2026 and if you need support from your current pension scheme administrator in connection with your preparations for the commencement of auto-enrolment, you would be well advised to reach out now, rather than waiting until later in the year.

A&L Goodbody LLP

Telephone: +35316492000

Website: www.algoodbody.com

Continue reading

We help hundreds of people like you understand how the latest changes in employment law impact your business.

Please log in to view the full article.

What you'll get:

- Help understand the ramifications of each important case from NI, GB and Europe

- Ensure your organisation's policies and procedures are fully compliant with NI law

- 24/7 access to all the content in the Legal Island Vault for research case law and HR issues

- Receive free preliminary advice on workplace issues from the employment team

Already a subscriber? Log in now or start a free trial